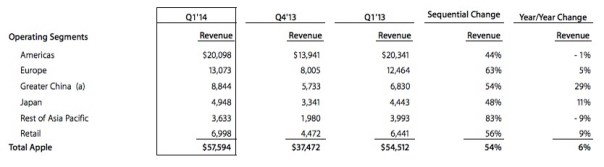

Breakdown of sales per region.

Shares in Apple fell more than 8% in after-hours trading after the firm reported flat profits of $13.1bn (£7.9bn) during the October to January quarter.

While the earnings beat expectations, the firm lowered it sales outlook for 2014, worrying investors.

Apple said it sold a record 51 million iPhones and 26 million iPads. Tim Cook acknowledged the iPhone 5C hadn’t met expectations.

Selling 51 million iPhones in the quarter was shy of the 55 million or so analysts had expected, reflecting intense competition from Samsung and others. In the December quarter, Apple recorded a net profit of $13.07 billion, flat from a year ago. Its gross margins came in at 37.9 percent, roughly in line with expectations.

Apple sold only 6 million iPods during the holiday quarter. That’s a decrease of 55% year over year for revenue and 52% for units when looking at the 12.7 million it sold in Q1 2013. That’s also the biggest year over year drop ever for the iPod, which fell from 15.4m units in Q1 12 to 12.7m in Q1 13 before being cut in half this year.

Whilst Apple seems to have suffered a drop in numbers in reality it was not alone. This was the same problem that faced every major phone company. The next quarter could prove very interesting with new products in the wings.

Maybe, phones have reached their natural plateau and it’s time for the next big thing. But despite their shares falling I still think it is staggering that a company can sell so many products which such a high price tag.